(NISBLF II)

The Northern Ireland Small Business Loan Fund II is administered by our fund management company, Ulster Community Finance Ltd, on behalf of Invest Northern Ireland.

Set up to provide access to finance for small businesses, sole traders and partnerships who are keen to develop their business but may find it difficult to access funding through traditional sources.

Our team at Ulster Community Finance Ltd, were initially awarded the fund management contract for NISBLF I and are currently contracted to fund manage NISBLF II.

With the loan support level now increased to £100,000 NISBLF II has the potential to lend over £9 million to local small and medium enterprises.

NI Small Business Loan Fund II

(Revolving £5.5m loan fund managed by Ulster Community Finance Ltd on behalf of Invest Northern Ireland commenced July 2018)

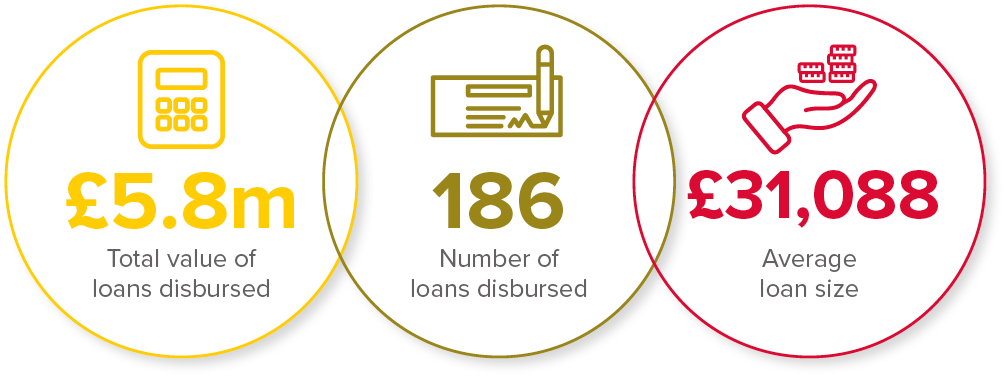

Figures to 31 December 2022:

Martin Hurls

County Antrim Business Hurls Towards Success with Northern Ireland Small Business Loan Fund

Randalstown-based solopreneur, Emmet Martin, established Martin Hurls in 2017 after identifying a market for high-quality hand-crafted Gaelic Games hurls.

As a child he worked alongside his father repairing broken hurleys and then began using ash trees from the family farm to make them. As well as selling directly to GAA club members in Ireland he has exported hurls to destinations including Belgium, Italy, USA and Australia. He has recently diversified into manufacturing hand crafted medal and keepsake boxes.

In 2022 Martin Hurls has secured £10,000 working capital from the NI Small Business Loan Fund allowing him to keep up with demand for products and to purchase stock.

“From the outset, maintaining product quality has been a top priority for me. With demand for high quality, customisable hurls remaining high, the NISBLF funding has allowed me to meet this demand and explore new business development opportunities. The NISBLF team recognised my growth ambitions for Martin Hurls and have been extremely supportive in terms of advice and insights.”

Emmet Martin,

Martin Hurls, Co. Antrim